Table of Contents

- Efficient Tax Preparation With H&R Block Checklist Excel Template And ...

- Printable Tax Prep Checklist Tax Return Organizer Financial | Etsy ...

- Gift Tax Deduction 2025 - Edee Kettie

- Free Printable Download! Your Ultimate Simple Tax Preparation Checklist ...

- Key 2021 tax deadlines & check list for real estate investors - Stessa ...

- Arnold Strongman Classic 2025 Winner - Silke Ehrlichmann

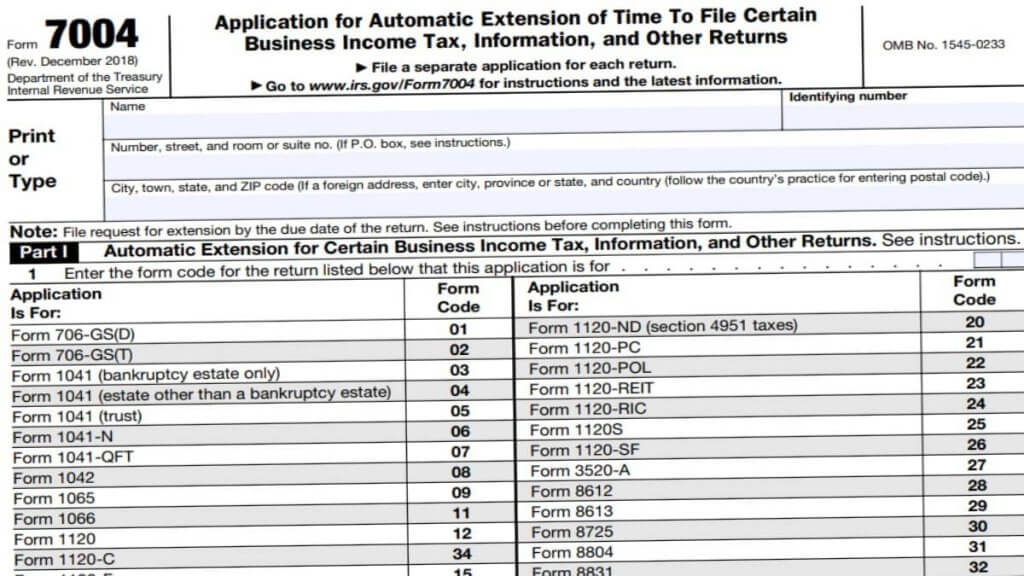

- Tax Deadline 2024 Extension Form 2024 - Meade Jocelyn

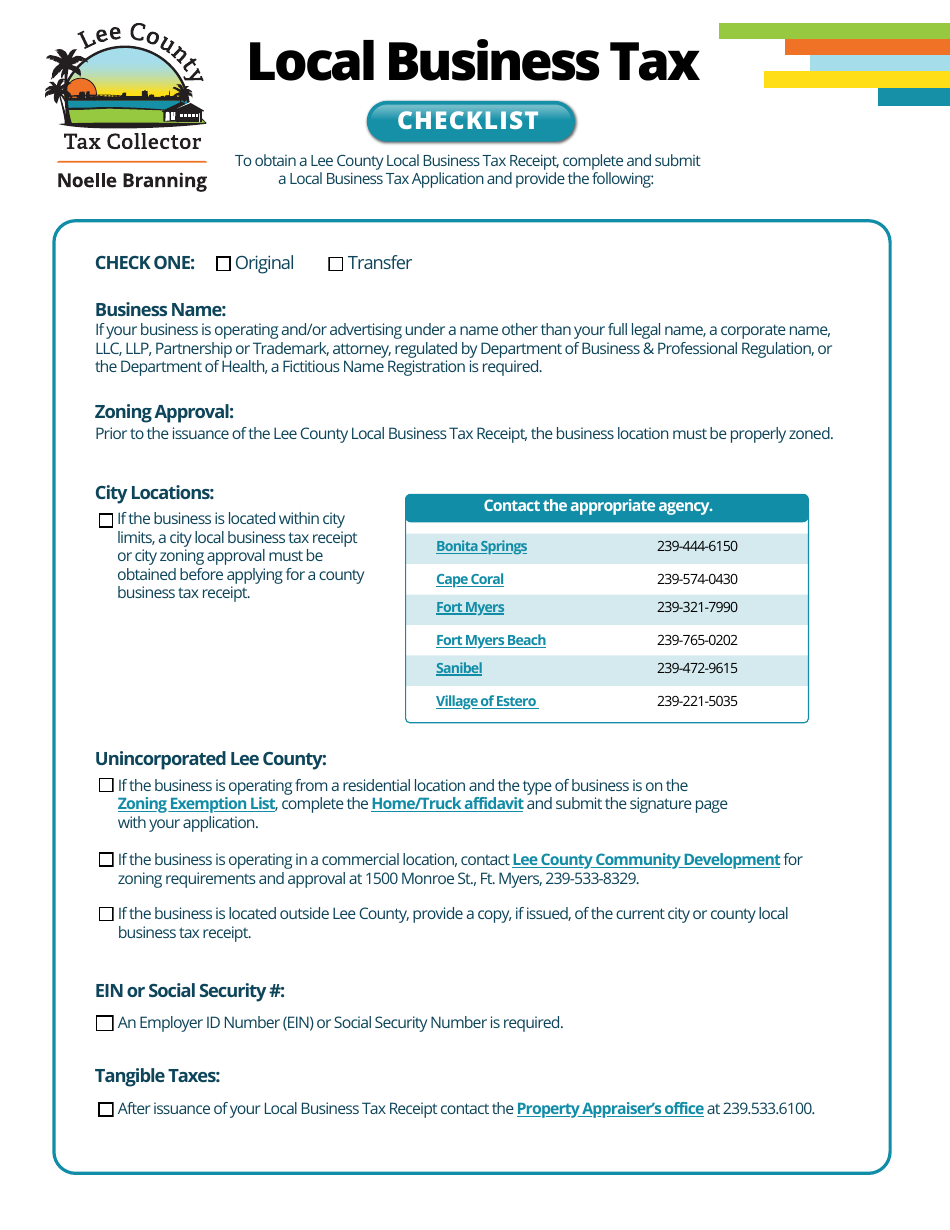

- Lee County, Florida Local Business Tax Checklist - Fill Out, Sign ...

- 2025 Estate Tax Exemption | Mariner

- Tarot 2025 Watch Free - Owen Jibril

Gather Necessary Documents

Choose Your Filing Status

Your filing status determines your tax rates and eligibility for certain deductions and credits. The most common filing statuses are: Single Married Filing Jointly Married Filing Separately Head of Household Qualifying Widow(er)

Report All Income

Make sure to report all income, including: Wages and Salaries Self-Employment Income Investment Income Rental Income Other Income

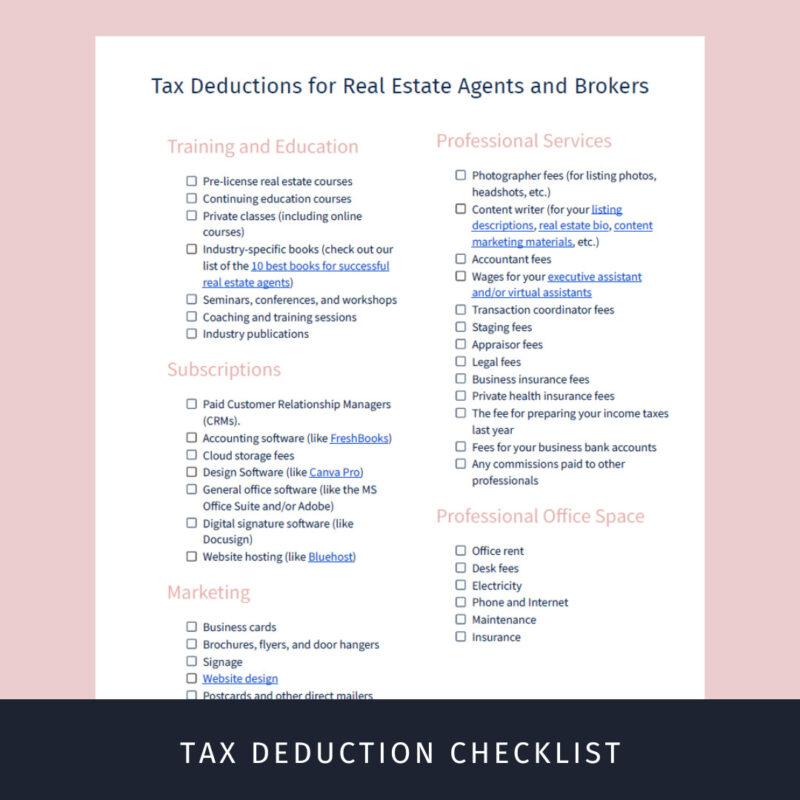

Claim Deductions and Credits

Maximize your refund by claiming eligible deductions and credits, such as: Standard Deduction Itemized Deductions Earned Income Tax Credit (EITC) Child Tax Credit Education Credits

E-File with H&R Block

Once you've gathered all necessary documents and information, it's time to e-file your taxes with H&R Block. With their expert guidance and support, you can: Prepare and File Your Taxes with ease and accuracy Get Maximum Refund with their comprehensive deduction and credit checks Receive Audit Support in case of an audit By following this comprehensive tax prep checklist, you'll be well on your way to a stress-free tax filing experience with H&R Block. Don't wait until the last minute – start preparing your taxes today and take advantage of H&R Block's expert guidance and support.For more information, visit the H&R Block website or consult with a tax professional. Stay ahead of the tax season and ensure a smooth filing experience with H&R Block.

Note: Word count - 499 words. This article is optimized for search engines with relevant keywords, meta titles, and descriptions. The HTML format is used to structure the content and make it more readable.